10. February 2022

Reading Time: 4

Min.

news

CSRD: What you need to know about Sustainability reporting

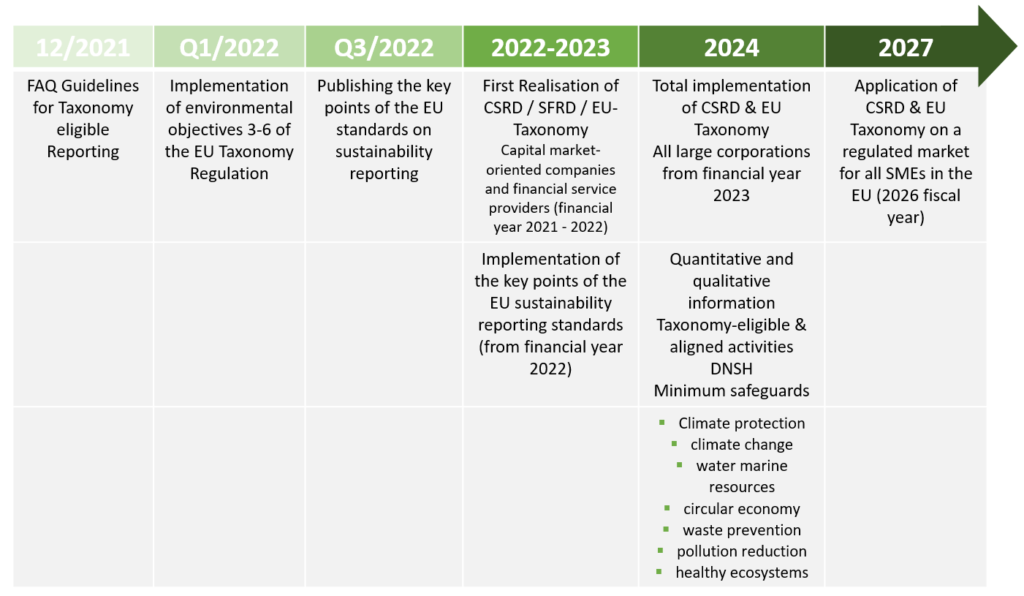

Due to the EU Non Financial Reporting Directive (NFRD), which was implemented in Austria by the Sustainability and Diversity Improvement Act (NaDiVeG), mandatory sustainability reporting has already existed within the EU since 2017 for certain (large) public interest entities (PIE) as well as for financial service providers and insurance companies. On 21 April 2021 the European Commission published the draft for the Corporate Sustainability Reporting Directive (CSRD). It contains among other extensions significant expansion of the scope of the reporting obligations.

Who will be affected by the sustainability reporting requirements in the future?

Sustainability reporting within the framework of the CSRD is obligatory to

- All large companies (as defined in § 221 para 3 UGB)

- All listed companies (with the exception of listed micro-enterprises as defined in § 221 para 1a UGB).

CSRD reporting requirements for large companies

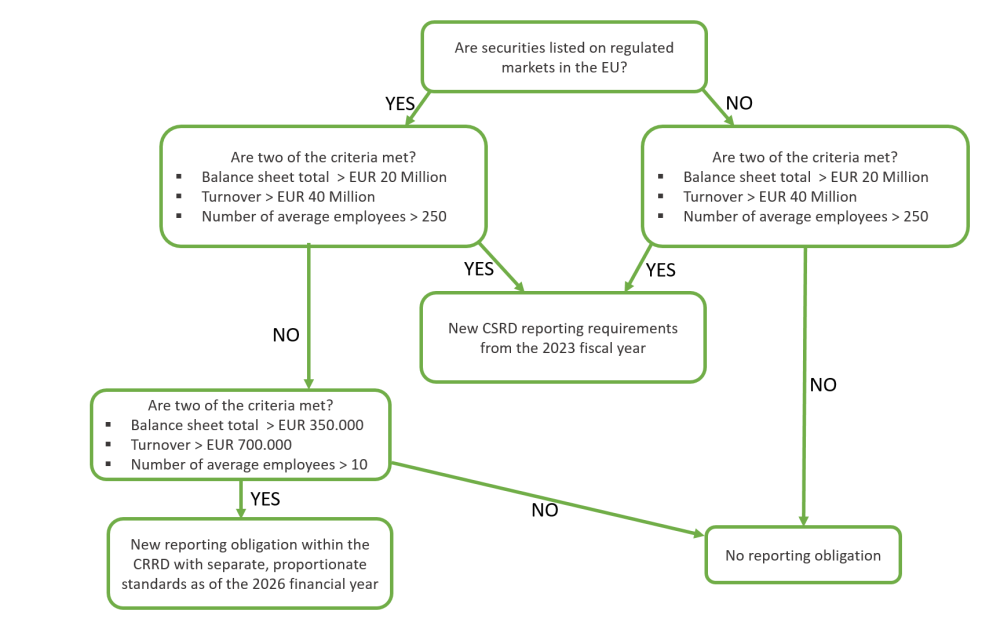

Thus, in the future, non-capital-market-oriented large companies will also fall within the scope of the CSRD. To qualify as a “large” company, two of the following three criteria must be met:

- Balance sheet total > EUR 20 Million

- Turnover > EUR 40 Million

- Number of average employees > 250

CSRD: Sustainability Reporting for SMEs

After the CSRD enters into force, a transitional period of three years for the reporting obligations for small and medium-sized enterprises that are listed on a regulated market in the EU is foreseen. In addition, separate reasonable sustainability reporting standards for small and medium-sized enterprises are to be created by 31 October 2023, which can also be applied on a voluntary basis by unlisted SMEs.

A company qualifies as “small” or “medium” if it meets two of the following three size criteria:

- Balance sheet total > EUR 350.000

- Turnover > EUR 700.000

- Number of average employees > 10

Whether the planned facilitation is applicable to small and medium-sized listed companies in Austria depends on the specific implementation. Otherwise, from an Austrian perspective, pursuant to section 198a (1) (a) UGB, companies whose transferable securities are admitted to trading on a regulated market within the EEA would be considered public interest entities and thus always constitute large companies pursuant to section 221 (3) UGB.

Exemption for consolidated sustainability reporting!

The CSRD provides an exemption provision for companies that are included in a consolidated sustainability report of a superordinate company that complies with the CSRD. Thus, a consolidated sustainability report at the level of the parent company has an exempting effect, whereby the required information can no longer be published in a separate report in the future, but must be integrated in the management report. Exempted subsidiaries must publish the consolidated management report and refer to it in their own management report. According to the draft of the CSRD, companies covered by the sustainability reporting obligation are to make their annual or consolidated financial statements, including the management reports, available in a uniform XHTML format.

The obligation to apply the CSRD can be illustrated with the following decision tree:

When does the new reporting obligation apply?

The CSRD is a fundamental update of the NFRD and is to be transposed into national law by the EU member states by 1 December 2022. According to the current timetable, the new requirements are to apply from 1 January 2024 for the 2023 financial year. This means that both listed and non-capital-market-oriented large companies must prepare a sustainability report for financial years beginning after 1 January 2023. Uniform European Sustainability Reporting Standards are to be defined for this purpose from October 2022.

For small and medium-sized listed companies, the reporting obligation with their own simplified standards is planned after a transition period of three years, i.e. in 2027 for business years beginning after 1 January 2026. All other companies that are not obliged to report on sustainability, i.e. companies that either do not meet the size criteria (for “large” companies) or are not listed on an EU-regulated market, can do so on a voluntary basis.

Kleine und mittlere börsenotierte Unternehmen ist die Berichtspflicht mit eigenen, vereinfachten Standards nach einer Übergangsfrist von drei Jahren, somit 2027 für Geschäftsjahre, die nach dem 1. Jänner 2026 beginnen, geplant. Alle anderen Unternehmen, die nicht zur Nachhaltigkeitsberichterstattung verpflichtet sind, somit Unternehmen, die entweder die Größenkriterien (für „große“ Unternehmen) nicht erfüllen oder nicht an einem EU-regulierten Markt notiert sind, können diese auf freiwilliger Basis durchführen.

The timetable can be presented as follows:

| What does SFRD means?

Sustainable Finance Reporting Disclosure (SFRD) is a regulation on sustainability-related disclosure requirements in the financial services sector. In German it is “Transparenzverordnung”. |

Due to the planned changes to the NFRD through the CSRD, sustainability reporting will become even more important; investors, banks and other stakeholders in particular will take sustainability information into account in their decision-making process. With the considerable extension of the reporting obligation to all large companies and all listed companies (with the exception of listed micro-enterprises) and the associated requirements, many companies will face new challenges, but also opportunities. Companies that already deal with the planned changes and requirements by the time of first-time application for the 2023 financial year and take the necessary steps to implement them in the best possible way can benefit from a competitive advantage.

Contact our experts about the new CSRD & sustainability reporting requirements and if you have any questions as to whether your company is affected or how you can benefit from the trend towards sustainability! Read also our TPA Sustainability Report.

ESG & CSR requirements for companys

Find out more what companies need to know about ESG & CSR requirements now: